Auto Insurance in and around Hiawatha

Hiawatha! Are you ready to hit the road with auto insurance from State Farm?

Insurance that won't drive you up a wall

Would you like to create a personalized auto quote?

- Cedar Rapids

- Hiawatha

- Marion

- Omaha

- Iowa City

- Lincoln

- Des Moines

- Davenport

- Dubuque

- Linn County

- Illinois

- Nebraska

- Minnesota

- Grand Island

- Tiffin

- Waukee

- Aurora

- Naperville

- Ames

- Sioux City

- Fairfax

- Solon

- Mount Vernon

- Peoria

You've Got A Busy Schedule. Let Us Help!

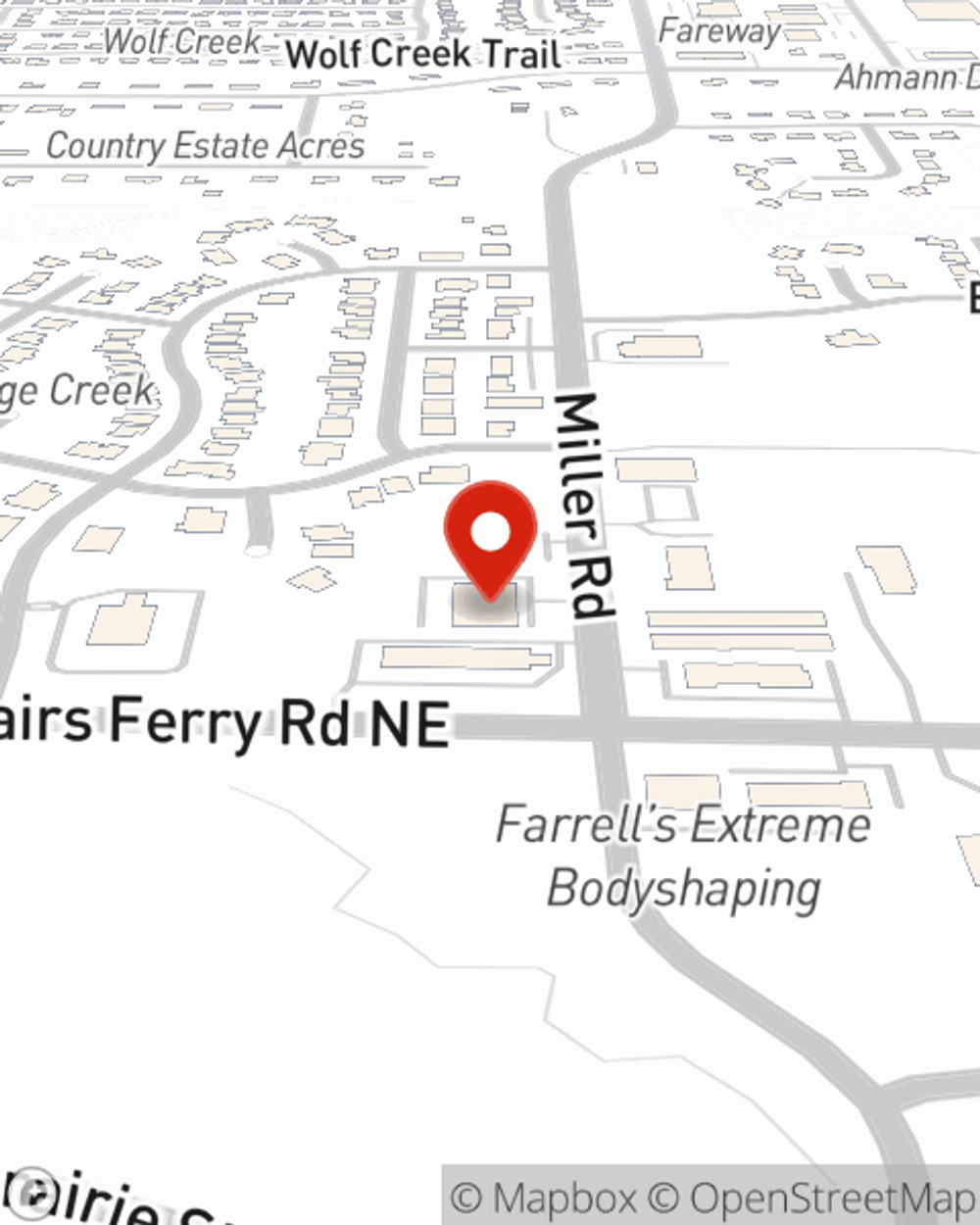

You want an agent who is not only knowledgable in the field, but who is also caring and attentive. That's State Farm Agent Mitch Valentine! Hiawatha drivers choose Mitch Valentine for a protection plan aligned with their specific needs, from the State Farm name.

Hiawatha! Are you ready to hit the road with auto insurance from State Farm?

Insurance that won't drive you up a wall

Protect Your Ride

Whether you're looking for reliable protection for your vehicle like collision coverage, comprehensive coverage and liability coverage, or wonderful savings options like an older vehicle passive restraint safety feature discount and accident-free driving record savings, State Farm can help. State Farm agent Mitch Valentine can help you identify which individual options are right for you.

When the unexpected puts you off road, coverage from State Farm can help. Get in touch with agent Mitch Valentine to find out the advantages of State Farm auto insurance.

Have More Questions About Auto Insurance?

Call Mitch at (319) 395-0035 or visit our FAQ page.

Simple Insights®

Motorcycle won’t start?

Motorcycle won’t start?

These handy tips can help you troubleshoot possible reasons why your motorcycle won’t start.

Insurance terms simplified: the basics

Insurance terms simplified: the basics

Knowing your insurance basics can help you on your path to understanding your policy and coverage. Here’s some terms you’ll want to know.

Mitch Valentine

State Farm® Insurance AgentSimple Insights®

Motorcycle won’t start?

Motorcycle won’t start?

These handy tips can help you troubleshoot possible reasons why your motorcycle won’t start.

Insurance terms simplified: the basics

Insurance terms simplified: the basics

Knowing your insurance basics can help you on your path to understanding your policy and coverage. Here’s some terms you’ll want to know.